TCO or TCM?

Certainly if you compare alternative power trains, vehicle taxation should be part of your TCO comparison. Today, in countries where there is a link between C02 emissions and vehicle taxation and/or incentives for electric vehicles are in place, vehicle taxation can be part of the positive business case.

Mobility solutions have their specific taxation element. Evolving from TCO to TCM should include taxation. Part of the avoided taxation cost could stimulate the transition.

The changing market conditions is also affecting the legal and tax framework. Mobility budgets are changing how companies fund and offer vehicles to their employees.

The future best practice fleet policy will look very different to the traditional company car option of today...the move from TCO to TCM is still unknown by many.

Bart Vanham – Managing Partner

As you may expect, TCO can fluctuate within countries but local prices and different taxation legislation can double the final price you pay. Fuel cost for example is a local cost that impacts final TCO, but local legislation such as CO2 taxation levels all contribute to different TCO across the exact same vehicle. Our analysis and benchmarking will allow you to evaluate your fleet policy in detail and then adapt it is required.

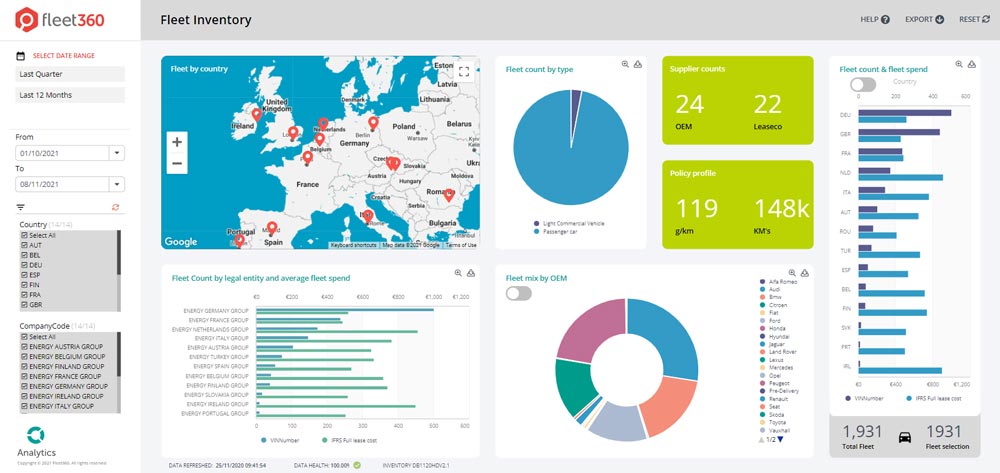

Taxation analysis built into our 'Insights' Dashboards

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.