The motor insurance portfolio has historically been unprofitable in Europe. Prices have declined over time and margins have had the last decimal percentage point squeezed out of them. As a result many insurance companies have exited the market entirely or are reviewing their rates and propose more restrictive terms and conditions.

In some markets, like the Netherlands, the last few years have been characterised by intense competition and waning profitability, forcing some companies to transform their operations or to stop operating in those markets.

A wide range of regulatory, risk and economic factors determine insurers’ calculations of premiums. Premiums are set in proportion to expected risks and need to cover not just expected claims but also operational and administrative costs and other obligations. All these factors differ widely from one country to another, which explains the varying levels of average premium across Europe.

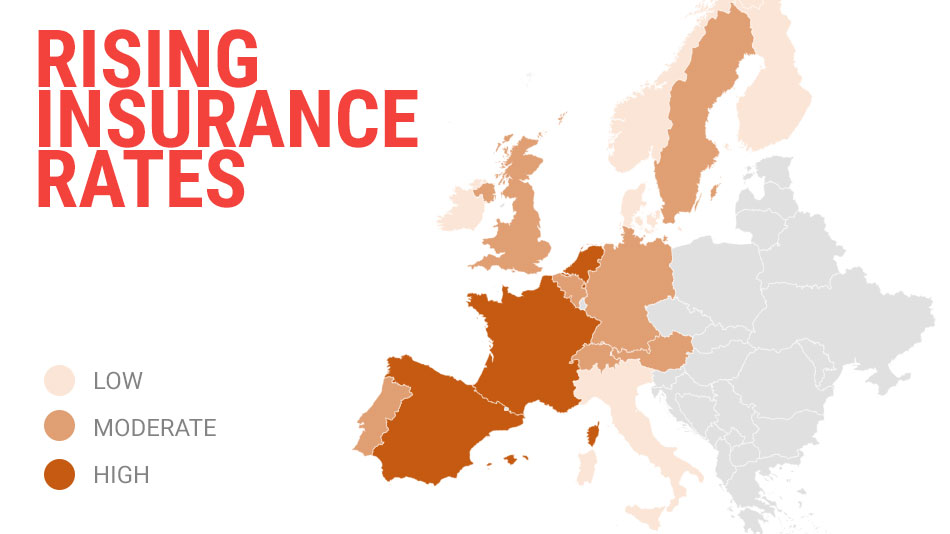

Due to that variation in average premium volume per country, there is also a difference in the appetite of the insurers per country. But in the larger EU markets, like Germany, UK, Portugal, Sweden, Belgium premium insurance rates are increasing between 5-10% and in France, Spain and the Netherlands above 10%. Next to premium rates the acceptance process applied by the insurers becomes more strict, as well as the limits & level of deductibles.

Only for Italy, Ireland, Norway and some Nordic countries the premium rates remain more or less stable.

Therefore corporate fleets should create insight in their insurance portfolio. By this we mean not only premium payments, but also damage statistics and coverage over the past years. This will be the basis to analyse if the insurance structure is the most appropriate one, if the premium rates per individual cover are acceptable and last but certainly not least how accident cost & frequency are evolving.

Transparency in accident statistics will also allow to take the appropriate in measures in terms of prevention, both to the equipment as towards the ‘individual’ driver.

Ultimately this will be the driving factor to ensure that your insurance cost will be the same in the future.

Fleet360 can help by creating the necessary transparency in order to ensure an appropriate coverage at the best possible conditions. We do this based on a potential assessment, which is a unique method of giving a quick and comprehensive insight into the potential of clients motor insurance, enriched with our benchmark data.

Once the program is installed we provide a dashboard reporting to monitor all key components to maintain the benefit towards the future, as well as the set up of prevention program to create a safety culture within the company.

Contact us for more information and a discussion on how we can help you with your insurance set up.

Installing the appropriate insurance structure and monitoring your insurance spend saves you both on premium rates and taxes. During an assessment we typically identify potential savings for our customers of over €100 – per vehicle per year. Insurance spend can be further driven down by actively working on prevention. Take control of your rising fleet insurance rates!

Steven Mertens