Tax changes from 1 July 2023 in Belgium heralded the likely end of Plug-in Hybrid cars (PHEVs). Indeed, PHEVs ordered from that date will be treated as non-zero-emission vehicles and face “negative” taxation in an annual increasing limitation of the tax deduction and, more so, the CO2 contribution multiplying, by a factor of 2.25 to a factor of 5.5 from 2026.

A PHEV would soon become at least 40 eur more expensive per month, rising to 150/200 eur per month towards 2026. The end of the PHEV?

Until TCOFleet, (credit where credit is due) questioned the interpretation of the calculation of the minimum CO2 contribution. This led to a written question to the relevant authorities and they confirmed that one must first calculate the amount of the CO2 contribution using the normal formula with new factors to then look at the evaluation against the minimum amount of 31.34 eur/month (for 2023).

For a petrol PHEV of e.g. 30 gr CO2, this means:

[(30 x 9 EUR) – 768] / 12 x 1.5046 x 2.25 = -140.49 eur but with a minimum of 31.34 eur.

Based on the published table, we learn that one pays more than the minimum from 79gr of CO2 emissions. This means that all PHEVs pay the minimum contribution of 31.34 eur per month (until further notice and like the full electric cars).

So nothing to worry about?

Surely so because from 2025 a maximum tax deduction of 75% applies, from 2026 50%, 2027 25% and 2028 0% for non-zero emission vehicles ordered before 1 January 2026.

But what does this mean financially?

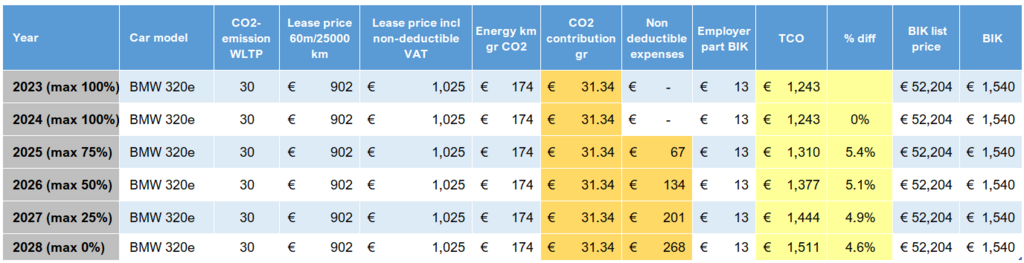

Take a look at the following example:

With the deduction limitation to a maximum of 75%, the (average) car in the example has an impact of +/- 5.4% of the TCO or 66 eur per month (all other tax costs not indexed). A further deduction limitation in 2026, 2027 and 2028 has a doubling, tripling and quadrupling of the additional cost. Spread over a 5-year term (July 2023- July 2028), this gives an average monthly extra cost of +/- 107 eur per month.

The TCO increases from 1243 eur per month in July 2023 to 1511 eur in July 2028 or an average TCO of 1350.20 eur per month over the 60-month term.

Is it better to have a shorter lease term?

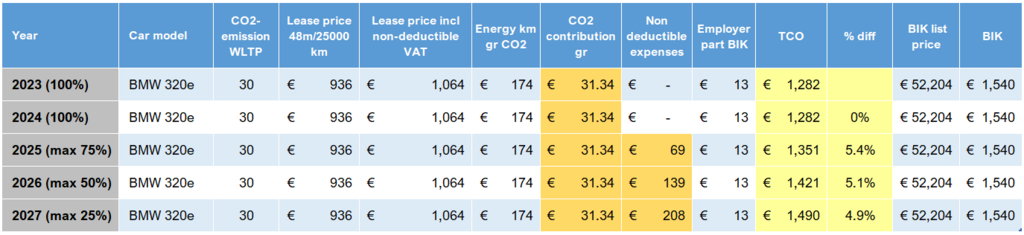

A shorter lease term usually results in a higher lease price. In our example:

Shortening the lease term to 48 months increases the lease price to 936 eur per month (in this example) but reduces the additional tax cost to an average of 78 eur per month. The TCO increases from 1282 eur per month in July 2023 to 1490 eur in July 2027 or an average TCO of 1372 eur per month over the 48-month term.

On average, the TCO is 22 eur per month more at 48 months than at 60 months. In this example, it is better to lease at 60 months. It is worth setting up this exercise for the chosen car list or available budgets.

Is PHEV more expensive?

107 eur more expensive per month in our example at 60 months is not insurmountable for those who (mentally) prefer range comfort or those who cannot recharge at home and drive quite a lot of kilometres and still want a tax-friendly car. After all, the benefit in kind due to private use of the PHEV remains minimal or close to the minimum of 1540 eur (for 2023, to be “indexed” for future years).

Moreover, we analysed that an equivalent electric car (e.g. BMW i4 Gran Coupe eDrive35 286hp) is on average +/- 60/70 eur more expensive in lease price per month, albeit with a slightly lower cost for energy.

This means that, until electric cars get closer to the lease prices for plug-in hybrid cars, the TCO for both will be quite close, with a slight advantage for the full electric car (in our example).

Long live the PHEV?

Yes, if the PHEV is used optimally. That is, it runs mainly on electricity and only on petrol/diesel to a limited extent (maximum 30% is put forward as a benchmark).

The electric range of the latest PHEV models goes up to 80 km and above, for smaller cars it’s 50 km and above. This means that most trips (one-way travel) should not exceed 50km with the ability to charge at home and at work. For example, ideal profile is a person who lives less than 50km from work, can charge at home as well as at work. This person will only need to use non-electric mode for longer professional or private journeys, resulting in an optimal energy cost.

If the company fails to profile this correctly in its choice of power train or to include this charging rule in its car policy and/or not to monitor it, it will end up with a substantially higher fuel cost than originally budgeted. Consumptions six times higher, than stated consumption figures by the car manufacturer, are no exception resulting in an exploding TCO.

Not the right profile? Then opt for full electric if the charging options are there. If they are not and many kilometres are driven with trips over 50km, then still opt for diesel or hybrid (not PHEV).

Long live the PHEV for the right usage profiles and charging attitude!

If you would like to review your car policy or strategy with regard to drives or your ideas with regard to your mobility solutions and get full transparency to make decisions on the right basis, do not hesitate to contact us.