The cost of company cars usually follows closely behind personnel costs as an important item in the income statement. It is not uncommon for certain costs related to the company cars to “hide” elsewhere in the income statement and this does not lead to transparency.

However, a good policy can be set up by measuring TCO. The Total Cost of Ownership, the costs that a company car actually costs the company over its useful life. This is measured as indirect and indirect costs.

TCO Types

There are various concepts of TCO in the market. TCO1, TCO2, commercial TCO, etc… the most correct approach to a TCO is the definition of the TCO included in the Act of 19 March 2019 regarding the statutory mobility budget (TCO2 plus additional mobility costs).

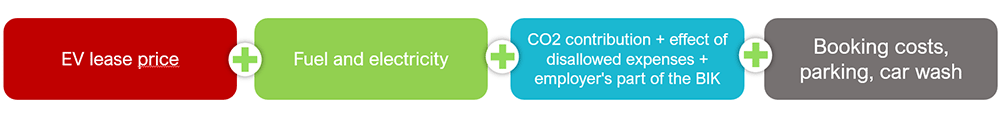

This TCO (TCO2) mainly consists of 3 (car) building blocks, possibly supplemented by a fourth to arrive at the mobility budget.

The first building block

This includes the depreciation costs, financing costs, maintenance costs, tires, insurance, etc. of the company car. If the cars are not leased, a depreciation of 20% per year must be taken into account.

The second building block

This is the energy cost of the car. This is influenced by the annual kilometres driven, the consumption of the car and the fuel cost in eur/litre or eur/kwh.

The third building block

This includes the tax cost of the company car. It is not uncommon for it to be found in other parts of the income statement.

It includes the CO2 contribution that is influenced by the propulsion of the car and the CO2 emissions. Furthermore, this also includes the additional tax cost due to the effect of the disallowed expenses: the car expenses that may be deductible to a limited extent and the tax effect of the employer’s part of the benefit in kind, being 40% of the BIK if a fuel or charging card is provided.

This effect can be seen as follows:

Example

Suppose 100 revenues versus 100 costs means accounting result 0 and therefore no (corporate) taxes to pay. Suppose that these costs are only 50% tax deductible, then, although accounting result is 0, the tax result is 50. For example, 25% corporation tax is due on this. Consequently, the cost to the company is 100 plus 12.5 taxes.

The leasing companies often use the commercial TCO that also takes into account the tax effect of the 100 costs, i.e. if the 100 costs were not there, 25 more tax had to be paid, so the commercial TCO is 112.5 minus 25, so still 87.5.

We describe the fourth building block when we discuss the mobility budget.

TCO as a measuring tool

If you map out the TCO of the fleet every year, you as CFO will know which direction the costs are going and which cost (or TCO) components deserve your special attention.

To calculate the TCO, you need data. Data from the leasing company, lease costs, insurance costs, exceptional costs, the CO2 emissions of the cars, type of drive, data related to actual kilometres driven, fuel costs, consumption of the charging sessions, shifts in the fleet, etc.

Once you know what data is needed, but more importantly what data you can access with sufficiently high quality, you can start making your “baseline calculation”. If some data is not available or does not have the necessary quality, assumptions can be used. An example of this is the actual fuel consumption, which can be calculated on the basis of the actual kilometres and the CO2 emissions.

At regular intervals, e.g. semi-annually or annually, you can request new data and map out a trend in the TCO components. This allows you to monitor your fleet and the related costs and to make adjustments where necessary.

TCO as a basis for change

Change needs to be measured. TCO serves as a measuring instrument to measure results. However, the TCO also serves as a basis for implementing changes.

Electrification

If you want to compare power trains, a TCO (TCO2) approach is recommended, including tax costs. After all, it is precisely the tax building block and, to a lesser extent, the energy building block that, as a subsidizing effect, can compensate for the (still) more expensive purchase cost, possibly translated into a more expensive lease cost, of an electric car.

In most cases, the TCO for an equivalent electric car is at least equal to or less than the TCO of an equivalent driving diesel car. Only in the small car segment can this sometimes be a challenge because the battery cost weighs heavily in the relative cost of the car.

This trend in which the TCO of an electric car is cheaper than that of its petrol, diesel or even plug-in hybrid equivalent will continue due to a more expensive taxation of non-zero-emission (NZE) cars in the coming years with 0% tax after from 2026, a lower residual value of these NZE cars and increasingly cheaper electric cars. Electrification is a must!

Mobility budget– the ‘Fourth Block’

If you want to switch to a mobility budget, you must by definition and legally use the TCO as a basis. This includes the three building blocks, linked to the company car, as discussed earlier, and a fourth building block of costs linked to other costs of the car or mobility that the employer (additionally) takes care of.

Examples of this are bicycle allowances or allowances for the use of public transport if a company car user can claim these on top of his company car. It also concerns the deductible or end of lease cost, damages, costs of (external) fleet management, etc., that the employer takes charge of in the context of the use of the company car. These costs may be added to the TCO as the basis for the mobility budget.

After all, the mobility budget is equal to the TCO (building block 1-4) of the company car that the employee could choose and that the employee exchanges for a mobility budget. In theory, this is an individual approach in which at the beginning of the year following the actual costs of the mobility used through the spending of the mobility budget must be compared to this mobility budget. If there is a surplus, the employee can receive the difference in favourably taxed (38.07%) cash. If there is a shortage, the employee must pay it back.

It is also allowed that the mobility budget per car policy category is based on an average TCO of the cars in that category or on the basis of the reference cars offered in that category. The advantage is that these are averages and in principle, company-wise, should reflect the total TCO or mobility budget of the company. SO in principle one can argue that no corrections have to be made annually (actual vs budget). Which, in principle, can mean significant savings in terms of administration.

Of course, in addition to a correct introduction of the mobility budget, one must also meet the set formal requirements, mobility policy, application by employee, mobility contract, description of the method used and specific mentioned exclusions of any other compensation, e.g. collective transport, etc. This requires the necessary attention.

TCO trends

If we take a general overview of the above exercise for the period 2021-2023, we can draw a number of conclusions:

Leasing costs

Leasing costs have risen considerably over the past year; Purchase prices of cars have risen, fleet discounts have generally decreased, residual values for certain drives have decreased, inflation for maintenance costs and higher insurance costs. Increases of 15 to 20% are no exception.

As a result, within the same car policy budget, an employee could no longer order the same car at the end of 2022 than the employees, within the same car policy category, a year ago. This can lead to dissatisfaction…. Consultation with your HR department is recommended.

Energy costs

Energy costs have also risen significantly, mainly due to the war in Ukraine. On the one hand, we see a downward trend in the number of kilometres driven due to increased working from home compared to the period before Corona. This trend seems to have levelled out and seems to be reversing some of the fact that employees are going back to the office more (social contact, heating costs, etc…). On the other hand, the price of fuel and electricity has risen.

All of this leads to an increase in energy costs. Presumably, your company will take the bots with the bump here. Perhaps further electrification of the vehicle fleet or the introduction of mobility solutions can offer solace.

Tax costs

The tax costs mainly consist of 3 components: the CO2 contribution, the tax effect of the disallowed expenses, the tax effect of the employer’s part of the benefit in kind if a fuel and/or charging card is provided.

These costs have also increased at the beginning of 2023: the indexation of the CO2 contribution and the limited tax deductibility of fossil fuel costs to 50% for plug-in hybrid vehicles. For non-zero emission (NZE) vehicles, these tax costs for cars ordered from 1 July 2023 have increased significantly.

From 1 July 2023, the tax deduction is limited over time for NZE cars ordered from 1 July 2023. Another 100% in 2023 and 2024, a maximum of 75% in 2025, 50% in 2026, 25% in 2027 and 0% in 2028. This 25% less tax deduction can quickly have an effect between 50 and 100 euros per month, depending on the size of the car and its lease price.

The CO2 contribution is also multiplied by a factor of 2.25 for NZE cars ordered from 1 July 2023. NZE cars will be ordered from 1 January 2025 by a factor of 2.75, from 2026 a factor of 4 and from 2027 by a factor of 5.5. Without taking into account the annual indexation, this means at least an increase from EUR 28.17 per month to +/- EUR 64 per month in 2024 and 2025 for a plug-in hybrid vehicle.

The tax effect of the employer’s part of the benefit in kind increased slightly due to a further decrease in the reference CO2 emissions and the minimum benefit in kind (EUR 1540 moving to 1600 for 2024). This has a rather marginal effect (e.g. 2.9 eur per month for electric vehicles).

TCO has risen considerably… What should I do?

It is important to follow these TCO evolution(s) and to perform an internal benchmark. What is the increase in the lease price of the most popular models within a car policy category? This ratio can then be used to discuss an acceptable increase in the car policy budget internally and to justify it in terms of budget.

At a time when attracting the right people can be a challenge, it seems logical not to offer smaller cars (or less equipped ones).

Alternatively, one can switch to electric cars and take a closer look at the lease parameters, term and (car policy) mileage. One can also decide to work with a car list in order to monitor the TCO “behind the scenes” and keep it under control or tight.

Mobility solutions and the legal mobility budget are the ultimate means of combining flexibility and budget control. Flexibility because by definition it is individually filled in by the employee on whom the mobility budget is spent (or not spent) and control since one has a budget that must be compared with the actual spent of mobility costs at the end of the year. In other words, transparent and budgeted costs in advance.

Supplier strategy, process optimisation and data transparency are further buzz words for fleet in 2024.

Conclusion

As a CFO, you cannot ignore the concept of TCO!

TCO and insights into it, will give you the opportunity to make and substantiate changes. It will allow you to make correct comparisons and react correctly to cost and market trends.

Consequently, TCO is an unavoidable concept for a good mobility policy.

Measuring is knowing!

Call us and lets talk.

Read more on TCO