The fleet market is getting ready for 2021.

The Internal Combustion Engine (ICE) as we know it has been around since 1876. That is a good run but, electrification is now a viable alternative power source and will finally allows us all to experience a better, cleaner technology. Legislation is helping to drive the change and the standard ICE cannot stay as it is. As you may know, the EU has set strict CO2 targets for 2021.

Cars and vans account for two-thirds of carbon emissions from transport, which is the highest emitting sector in the EU with 27% of total CO2 emissions. Transport is the only sector whose climate impact has grown since 1990. Also, last year the EU’s oil consumption – a good proxy for transport CO2 emissions – rose by 2%, the highest annual growth since 2001. The EU is currently debating a European Commission proposal for new car CO2 reduction targets of 15% and 30% in 2025 and 2030 respectively, but these targets would not be sufficiently demanding to enable EU countries to meet their binding 2030 climate goals.

So what is the OEM’s response?

- Most European OEM’s are set to meet EU’s 2021 CO2 reduction targets – in part by selling more EV and plug-in vehicles

- Only 6 of the top 50 models were upgraded in 2017 – but 21 will be re-launched as more fuel-efficient, low-carbon models in 2019-2020

- EV models are expected to increase five-fold to 100 by 2021, thus increasing driving-range, choice and competition

- Rising SUVs sales and increased power and performance are driving emissions increases

- CO2 impact of declining diesel sales is more than offset by lower-carbon vehicles

2018 is the year it changes

Almost all manufacturers will comply with the EU’s 2021 CO2 emissions reduction targets through a combination of selling more fuel-efficient and plug-in models and exploiting flexibilities in the regulation. Only six of the top 50 selling models in Europe received a full model upgrade in 2017 and very few new plug-in cars were made available – undoubtedly contributing to the lack of progress in reducing car CO2 emissions in 2017. And OEM’s have been holding back sales of both electric cars and more fuel-efficient upgrades of their best selling models in Europe.

Just four of the top-selling 50 models are set to be fully upgraded by the end of this year, followed by 14 in 2019, and seven in 2020. Seven upgrades per year is typical for the top 50 selling models. Planning is needed but the next 12 months will see an influx of new models:

| Audi E-Tron | 12 months + |

|---|---|

| BMW i4 | 6 months + |

| BMW iX | 6 months + |

| Citroen e-C4 | 9-12 months |

| Cupra Born | 3-6 months |

| DS 3 Crossback E-Tense | 3-6 months |

| Fiat 500e | 4-6 months |

| Ford Mustang Mach-E | 12-18 months + |

| Hyundai IONIQ | 6 months |

| Hyundai IONIQ 5 | 9-12 months |

| Jaguar iPace | 6-9 months |

| Kia Niro EV | 3-6 months |

| Kia EV6 | 6-9 months |

| Kia Soul | 3-6 months |

| Lexus UX300e | 15 months + |

| Mazda MX-30 | 3 months |

| Mini Electric | 6 months + |

| Nissan Leaf | 6 Months+ |

| Peugeot e208 | 3-6 months |

| Polestar 2 | 5-6 months |

| Porsche Taycan | 12 months + |

| Renault Zoe | 5 months |

| Skoda Enyaq iV | Coupe 9-12 months, SUV 12-15 months |

| Tesla Model S | 18-24 months |

| Tesla Model X | 18-24 months |

| Tesla Model Y | 6-12 months |

| Tesla Model 3 | 6-12 months |

| Vauxhall Corsa-e | 6-8 months |

| Vauxhall Mokka-e | 6-8 months |

| Volkswagen ID.3 | 12 months + |

| Volkswagen ID.4 | 12 months + |

Manufacturers’ strategy to comply with the 2021 targets is to increase sales of electric vehicles and plug-in hybrid vehicles (we think pure electric is the way forward) and this is likely to increase their market share in Europe significantly to 5-7% by 2021. But analysis shows that OEM’s are also holding back the launch of new plug-in vehicles until the last possible moment. There are only 20 battery electric cars on sale at present but by 2021 this is expected to leap to reach more than 100 if companies deliver on their announcements.

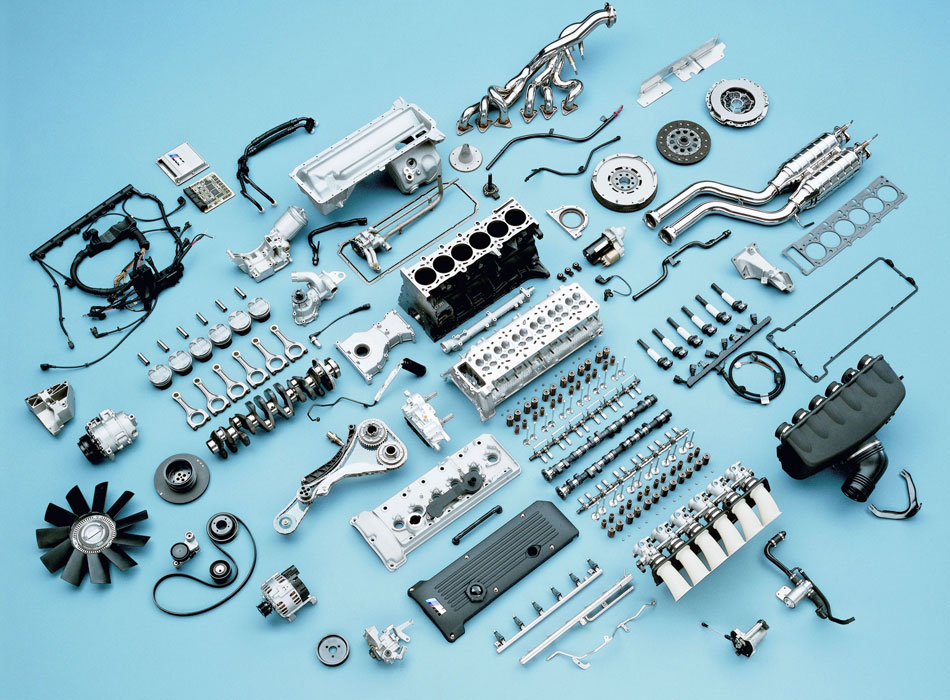

The Internal Combustion Engine is a bit complicated!

Electrification has thrown the car industry into turmoil. Its best brands are founded on their engineering heritage—especially in Germany. Unlike the complicated internal combustion engine, electric cars are much simpler and have fewer parts; they are more like computers on wheels.

That means they need fewer people to assemble them and fewer subsidiary systems from specialist suppliers. Carworkers at factories that do not make electric cars are worried that they could be for the chop. With less to go wrong, the market for maintenance and spare parts will shrink. While today’s carmakers grapple with their costly legacy of old factories and swollen workforces, new entrants will be unencumbered. Premium brands may be able to stand out through styling and handling, but low-margin, mass-market carmakers will have to compete chiefly on cost.

Essentially, there are big changes ahead and you have a new road to choose for the mobility of your drivers.

Start to plan now and consider mapping your driver mobility needs.